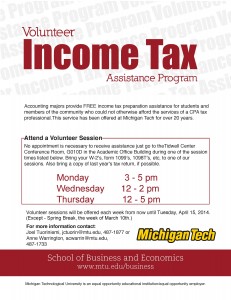

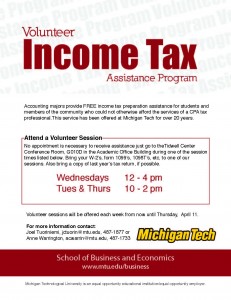

The Michigan Tech College of Business (COB) is pleased to again offer Volunteer Income Tax Assistance, a service offered at the University for more than 20 years. Accounting majors will provide free income tax preparation assistance for students and members of the community who could not otherwise afford the services of a CPA tax professional.

Assistance is provided by appointment via Google Calendar only. To schedule a 30-minute session, visit one of the following calendars: VITA, VITA-1, or VITA-2. You may need to check all three calendars for an available spot on a desired date/time. Walk-in and virtual appointments are not available.

Appointments, held in the Academic Office Building, Room G015, are available beginning Monday, March 13 through Wednesday, April 12 during the following times:

- Mondays 11 a.m.-1 p.m. and 3:30-5:30 p.m.

- Tuesdays 11 a.m.-1 p.m.

- Wednesdays 2 p.m.-4 p.m.

What to Bring

Bring your W-2s, form 1099s, 1098Ts, and any other tax statements to your session. If possible, bring a copy of last year’s tax return.

International students

Prior to your appointment, complete the Federal Form 1040 using the Glacier Tax Prep software provided by the University, and then bring the completed federal forms to your appointment for assistance with state tax return preparation.

Questions?

For more information, contact:

Joel Tuoriniemi, accounting professor

jctuorin@mtu.edu | 906-487-1877

About the College of Business

The Michigan Tech College of Business offers undergraduate majors in accounting, business analytics, construction management, economics, engineering management, finance, management, management information systems, and marketing, as well as a general business option. Graduate degrees include the TechMBA®, a Master of Engineering Management, a Master of Science in Accounting, and a Master of Science in Applied Natural Resource Economics.