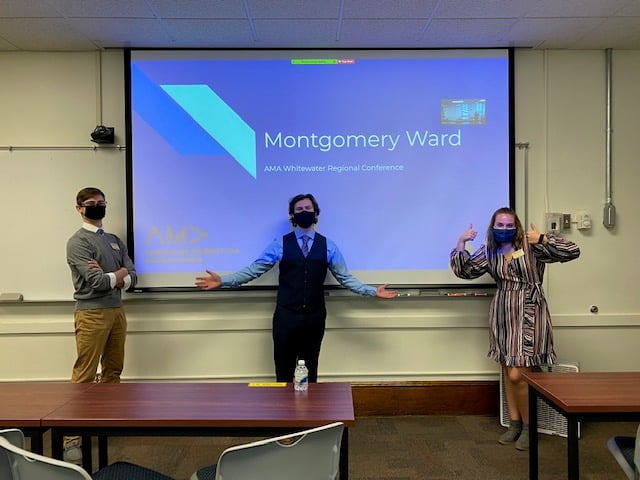

Three student members of the Michigan Tech chapter of the American Marketing Association (AMA)—Ryan Calkins (Management), Emily Kughn (Marketing), and Jaxon Verhoff (Marketing)—recently demonstrated their marketing strategy competence at the 2020 AMA regional conference hosted virtually by the University of Wisconsin–Whitewater.

The students were selected as top-10 finalists at the online conference where more than 800 students from 64 universities participated. They went on to place third on October 9, winning a cash award of $250.

In addition to this achievement, Michigan Tech was represented in the AcuRite Digital Marketing Strategy Competition and Gartner Sales Competition, where managers from the sponsoring companies served as judges.

Although COVID-19 disrupted the learning environment, Associate Professor of Marketing, Jun Min, who advises the marketing organization on campus, states, “I am continually impressed with our students’ willingness to try something new.”