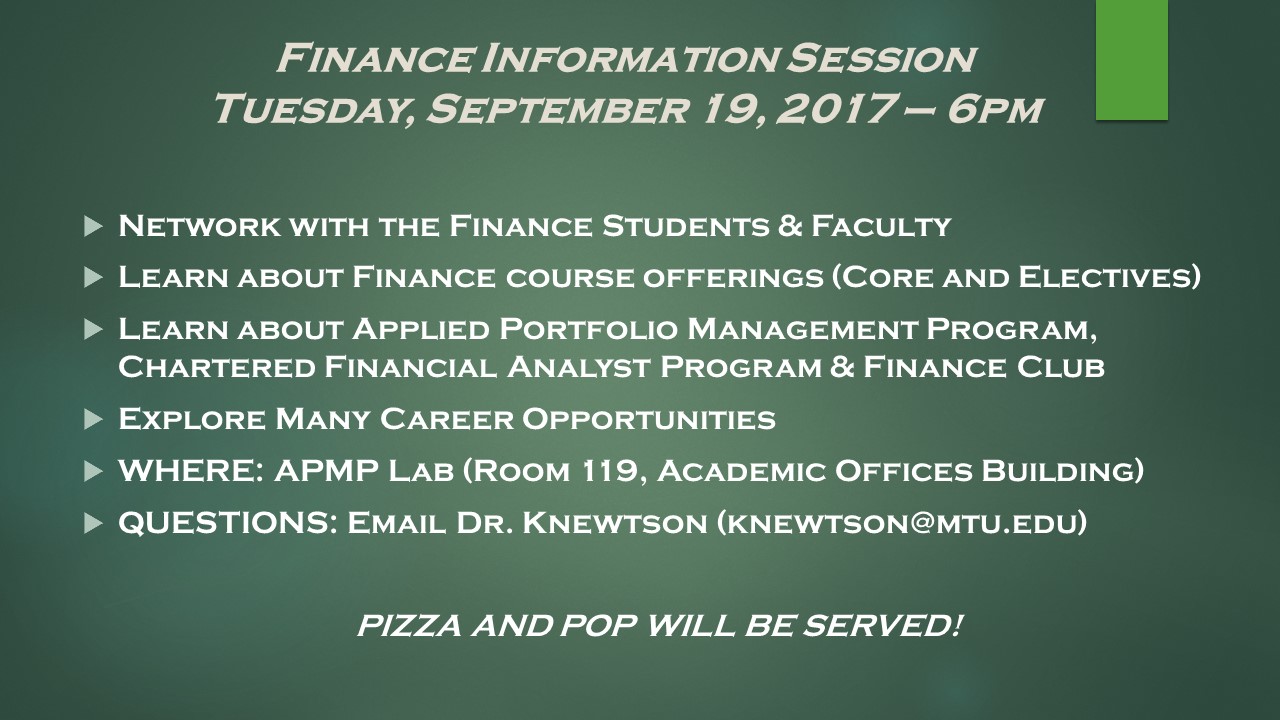

Please join us in the School of Business and Economics on September 19, 2017 from 6:00 – 7:00 p.m. in AOB 117 to network with finance students & faculty. Additionally, you can learn about finance course offerings, career opportunities, the Applied Portfolio Management Program, Chartered Financial Analyst Program and the Finance Club.

ENGAGE is a two day international investment education symposium. The goal at Engage is to help provide a level of insight into our financial system that students can’t learn from sitting in classrooms. To accomplish this goal Engage brought in some of the top financial professionals in the industry to host Q&A discussions.

ENGAGE is a two day international investment education symposium. The goal at Engage is to help provide a level of insight into our financial system that students can’t learn from sitting in classrooms. To accomplish this goal Engage brought in some of the top financial professionals in the industry to host Q&A discussions.