Amber Campbell ’96, the founder of G&A Garden Center in Houghton, is collaborating with area farmers to open a weekend Farmers’ Market at her garden center, 400 W. Sharon Ave. It will open this Friday, Aug. 8, and be open Fridays and Saturdays until harvest season is over.

Amber Campbell ’96, the founder of G&A Garden Center in Houghton, is collaborating with area farmers to open a weekend Farmers’ Market at her garden center, 400 W. Sharon Ave. It will open this Friday, Aug. 8, and be open Fridays and Saturdays until harvest season is over.

Locally grown, natural and organic fruits and vegetables and eggs will be offered, as well as jams and baked goods. Campbell calls the Farmers’ Market “an effort to bridge farmers and consumers in a natural, sustainable way.” The goal of her garden center, which opened in 2012, is to provide the community with local, natural and organic foods and plants.

Participating in the Farmers’ Market will be Niemela’s Market Garden of Pelkie; Wintergreen Farm of Ontonagon; Pike River Produce of Chassell; and Teresa’s Jam and Home Bakery of Chassell.

Hours will be 1-6 p.m. Friday and 10 a.m.-3 p.m. Saturday.

- Academic performance

- Communication skills

- Demonstrated commitment to the MIS major

- Financial need

Students majoring in Management Information Systems were invited to submit their resumes and personal essays explaining why they deserve this financial award and recognition. We sincerely appreciate the support and commitment of the MIS alumni who made this endowed scholarship possible: Jamie Linna, Steve Linna, Carrie Schaller and Greg Horvath.

Where does a giant international retailer turn when it needs innovative IT support? Michigan Technological University, of course.

Target Corporation, with international headquarters in Minneapolis, is the first retail firm to participate in Michigan Tech’s signature Enterprise program. In the Enterprise program, teams of students work with a business or industry sponsor on a real-world problem that the sponsor would like the students to help solve.

ITOxygen is an Enterprise that specializes in information technology (IT) solutions. Their motto: We breathe new life into information technology projects.

Target actually presented ITOxygen with several problems involving mobile app development and computer infrastructure. Over the school year, the students developed an app for the iPad that measures wi-fi connectivity throughout Target stories. Another app lets shoppers with Android smartphones build a shopping list and share it with others.

The shopping list app will be particularly useful for event planners, teachers and parents buying school supplies, or groups of students or others living together. “With it, you can avoid buying 200 boxes of Kleenex and no crayons, Russ Louks, ITOxygen’s advisor, explains.

The ITOxygen students also wrote scripts to automatically deploy servers nationwide. Then they were invited to present their work to a meeting of high-level corporate executives.

Target not only put money into the project, they really integrated the students into the corporate IT structure, says Rick Berkey, the Enterprise liaison between Michigan Tech and corporate sponsors. “The students are working right along with Target IT professionals, learning the language of the industry,” Berkey says. “That level of support and time commitment is unusual.”

Target has enjoyed recruiting for technical talent at Michigan Tech, says E. B. Hakkinen, process consultant for Target Corporation’s Technology Solutions. “Target was interested in continuing to build upon our strong relationship with Michigan Tech, she explains. “We wanted to deepen our partnership and technology brand on campus. We saw a unique opportunity through the Enterprise Program, specifically ITOxygen, to brand Target as an employer of choice for technology students, while collaborating with Michigan Tech students and giving them a first-hand experience of what it could be like to work for Target.”

“We learned a lot in our first year, 2012-2013, working with ITOxygen,” she continues. “This past year we experienced success with all of our ITOxygen projects. We found the best approach is to allow the students to be innovative in their solutions while we provide the support and tools necessary for them to be successful. We look forward to continuing our relationship and seeing innovative solutions from the ITOxygen students in the coming school year.”

As Berkey puts it, without a hint of a grin, “the ITOxygen students have been right on target.”

One of the students, David Shull, a computer engineering major, was especially impressed with Target’s commitment to integrating technology into retail sales. “It’s really exciting how innovative they’re being in mobile and web technologies,” he says.

Shull feels that the Enterprise project teaches skills that are hard to learn in a traditional classroom setting. “The most important thing I gained was the experience working on a corporate project with people from all over the country,” he says.

Projects like ITOxygen’s work with Target prepare students for their future in the working world, which is just what Target—the first retailer to come to Michigan Tech’s Career Fairs–wants. “Target is recruiting skilled IT employees,” says Berkey. “It’s more than a retail store.”

Shull says students need the kind of experiences the Target Enterprise project offered. “It’s too easy for students to think they know what ‘real’ work is like,” he says. “I hear students complain about how a concept they’ve learned won’t be of use in the real world. Opportunities like the Target Enterprise project give students hands-on experience that is guaranteed to be applicable in the real world, and demonstrates the value of concepts that were learned previously. They also facilitate self-learning, engineering management and other key skills.

“Plus—there is something really cool about walking into a Target store and knowing that you wrote an app the employees or shoppers are using.”

This story was originally posted in Michigan Tech News and written by Jennifer Donovan. To see the original story please view this link.

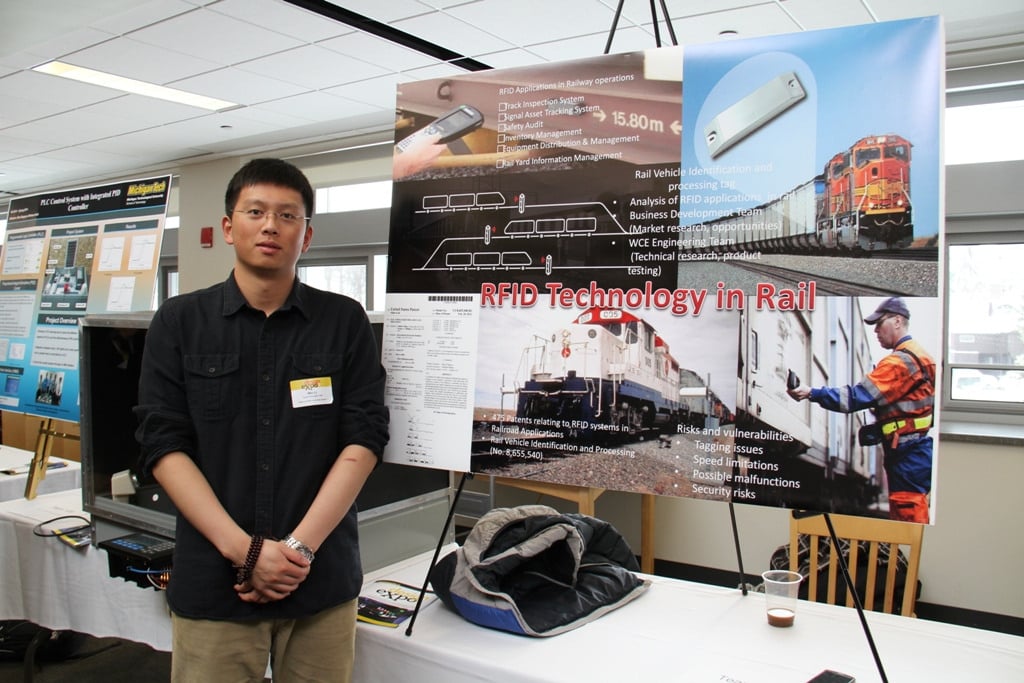

A team from the Business Development Experience Course (BUS 4992) tied for second place in the category of Design Expo Image Contest, in 2014’s Design Expo. This accomplishment is particularly impressive, as over 600 Michigan Tech students across all disciplines competed in this year’s hands-on, discovery-based learning program, hosted by the Institute for Leadership and Innovation and the College of Engineering.

A team from the Business Development Experience Course (BUS 4992) tied for second place in the category of Design Expo Image Contest, in 2014’s Design Expo. This accomplishment is particularly impressive, as over 600 Michigan Tech students across all disciplines competed in this year’s hands-on, discovery-based learning program, hosted by the Institute for Leadership and Innovation and the College of Engineering.

The team, titled “Balise and RFID Use in Rail Systems,” consisted of members Frank Kampe (’14, BS in Marketing), Min Li (’14, BS in Operations and Systems Management), Daniel Holmberg (’14, BS in Management), and Kevin Heras (projected graduation: Fall 2014, majoring in Management). In order to participate in the Design Expo, team members took the Business Development Experience two-course sequence, where business school students ascertain the commercial viability of potential projects. Since the implementation of the courses, business school students have been teaming up with the Enterprise and Senior design project teams to look at their technologies from a business perspective.

Team Advisor and Assistant Professor of Entrepreneurship and Innovation, Saurav Pathak, was pleased with his students and the work they conducted. “This group in particular made valuable recommendations to Technical Expert Network (TEN) on how to expand the use of Radio Frequency Identification (RFID) technologies in the US rail industry,” Pathak remarked. He added, “The fact that business school students were placed as award winners in an event that predominantly highlights the technological feats at Michigan Tech is proof that there is value in ascertaining the business prospects of these technologies.”

Congratulations to the team on their award!

August and Elizabeth Skultety [weren’t] the only ones in their family wearing caps and gowns at Michigan Technological University’s 2014 Spring Commencement Saturday. Their 3-year-old daughter, Charlotte, [was] right there with them in a miniature cap and gown in honor of her parents’ graduation from Michigan Tech.

August and Elizabeth Skultety [weren’t] the only ones in their family wearing caps and gowns at Michigan Technological University’s 2014 Spring Commencement Saturday. Their 3-year-old daughter, Charlotte, [was] right there with them in a miniature cap and gown in honor of her parents’ graduation from Michigan Tech.

“All of college has been a family experience for us,” said Elizabeth, who is receiving her Bachelor of Science in Chemical Engineering, “so it feels like she is graduating too. She has put up with all of our studying and other commitments.”

August is receiving a Bachelor of Science in Management with a concentration in supply chain and operations management. Yoopers born and raised—August from Gladstone and Elizabeth from Escanaba—the Skultetys will be moving to Midland, Mich., to start jobs at Dow Chemical. August will be a supply chain analyst for Dow, and Elizabeth will be a production engineer with Dow AgroSciences.

Both Skultetys have fond memories of their days at Michigan Tech. Elizabeth found the chemical engineering department very hands on and the professors very personable. She is especially grateful for the mentorship of Professor Julia King , under whom she conducted research. King not only helped Elizabeth with her studies, she helped the family find day care for Charlotte when they found themselves struggling with that.

Elizabeth was also very involved in the American Institute of Chemical Engineers and is currently the president of the Michigan Tech chapter.

August said he enjoyed working with the School of Business and Economics. He had special praise for Professor Dana Johnson, who he said was very helpful throughout his Tech experience.

Houghton also proved the perfect place to pursue some of their favorite activities; hiking, camping and playing in the snow.

The couple chose to work with Dow Chemical after positive experiences as interns there. “We both chose Dow because we really liked the company as a whole,” said Elizabeth. “They are a family oriented company, and we like the Midland community for that as well.”

The Skultetys are looking forward to the next chapter of their lives, at Dow. “We were able to both get internships, and I was able to go to a career fair after my sophomore year and immediately get a great internship with Dow,” said Elizabeth. “I was really happy that the job opportunities were so good.”

August called Dow “our first choice, so it [the career fair] enabled us to get positions with our first-choice company,” said August. “We both got hired in August, so we haven’t had to worry all year.”

Though the Skultetys are leaving, they have a bit of advice for the students who come after them: time management and a stable support system are the keys to success at Michigan Tech.

Although the family enjoyed their time in Houghton, they are ready to start the next part of their journey. “It is a relief [to graduate]. We are ready to move on and start the next chapter in our lives,” said Elizabeth. “We are closing on a house this summer in Midland. We are ready to settle down in a community and get some roots.”

As for the littlest cap-and-gown wearer, Charlotte is just a little sad to have to cover up the sparkly new dress she got for the occasion. She’ll get to show off a little bit of sparkle, though, with the sparkly white shoes she got to complete her ensemble.

Michigan Technological University (www.mtu.edu) is a leading public research university developing new technologies and preparing students to create the future for a prosperous and sustainable world. Michigan Tech offers more than 130 undergraduate and graduate degree programs in engineering; forest resources; computing; technology; business; economics; natural, physical and environmental sciences; arts; humanities; and social sciences.

*This article was written by Erika Vichcales for Michigan Tech News, and was re-posted with the author’s permission. Please click here to see the original posting.