Please contact Renee Ozanich or Lori Hardyniec at 906-487-2280.

Salary Verifications

Salary verifications that are sent to payroll must be requested at least 48 hours in advance. The department requesting the salary verification must include individuals full name, M number, and position number.

Federal Form W-4

The information supplied on the Federal Form W-4 form is used to determine the amount of Federal income tax to withhold from your paychecks. Failure to submit a Form W-4 or submitting an invalid form will default your W4 form to a status of single with no adjustments. This could result in the incorrect amount of federal taxes being withheld from your paycheck.

Form W-4 must be CURRENT year form. The W-4 form CANNOT be completed in pencil. The W-4 Form MUST be signed. If the W-4 Form is completed in pencil, is not the current year, or unsigned, it will be invalid. If W-4 is invalid the withholding amounts will be entered as a default setting of single with no adjustments until a valid form is received.

Form W-4 needs to be completed only once unless there is a change in address, tax status, or you claim exempt from federal withholding. Employees who claim exempt on their Federal W-4 will be asked to complete a new Federal Form W-4 before February 15 of each calendar year.

Basic Instructions –

Step 1 -Personal Information – name- first, middle initial (if you have a middle name), last (family)

social security number (leave blank if you do not have one)

home address – this is NOT your home country address but your local address

Marital status – Employees who are married may select “married, but withhold at a higher Single rate

Step 2 – Multiple Jobs or Spouse Works – Complete this section if you hold more than one job or are married filing jointly and your spouse also works. Only complete this section if it applies to you. Otherwise leave this section blank.

Step 3 – Claim Dependents – Enter dependent information as instructed and put the total on line 3. Complete this section only if it applies to you.

Step 4 – Other Adjustments (optional)– a. enter other income; b. enter other deductions (use worksheet on page 3); c. enter extra withholding. Complete this section only if it applies to you.

Step 5 – Sign and Date

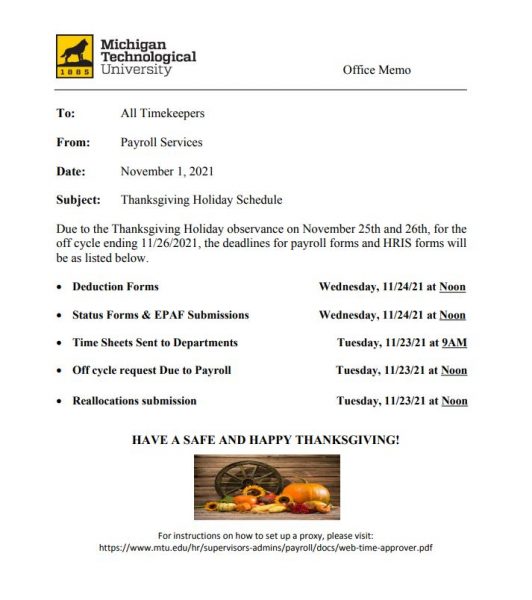

Due to the Thanksgiving Holiday observance on November 25th and 26th, for the off cycle ending 11/26/2021, the deadlines for payroll forms and HRIS forms will be as listed below.

- Deduction Forms: Wednesday, 11/24/21 at Noon

- Status Forms & EPAF Submissions: Wednesday, 11/24/21 at Noon

- Time Sheets Sent to Departments: Tuesday, 11/23/21 at 9:00AM

- Off Cycle Request Due to Payroll: Tuesday, 11/23/21 at Noon

- Reallocations Submission: Tuesday, 11/23/21 at Noon

Have a safe and happy Thanksgiving!